I attended the Adopting Bitcoin conference in Cape Town the last weekend and thought I’d do a quick writeup about some interesting things I learned.

Some background, South Africa has quite high crypto adoption (Bitcoin in particular). Our 2nd biggest retailer accepts crypto payments, there are a bunch of circular bitcoin economy projects around the country and more are popping up. Most of this activity is bottom-up, the government is not pro-crypto.

Pick ‘n Pay adoption of crypto payments

The first presentation was about SA’s 2nd largest retailer, Pick ‘n Pay, who has adopted crypto payments at its stores about 2 years ago. I don’t have a PnP at the small town where I live, so I’ve never used them.

While at the conf, I went to the local PnP and bought coffee and a magazine with Bitcoin. You can use the self-custodial Blink wallet (previously Bitcoin Beach) to pay. Apparently any wallet could work, but there is some API call that it needs to make which only Blink and some South African exchanges currently support.

3% of Pick ‘n Pay’s sales are in Crypto (not just Bitcoin, but also Solana and others), which is up from 0.5% 2 years ago. This is one million Rand per month, which is about $50.000. So not a large absolute amount, but trending up.

Bitcoin: the South African story

This was a first presentations was from Stafford Masie and Carel de Jager about their lobbying efforts to do the following:

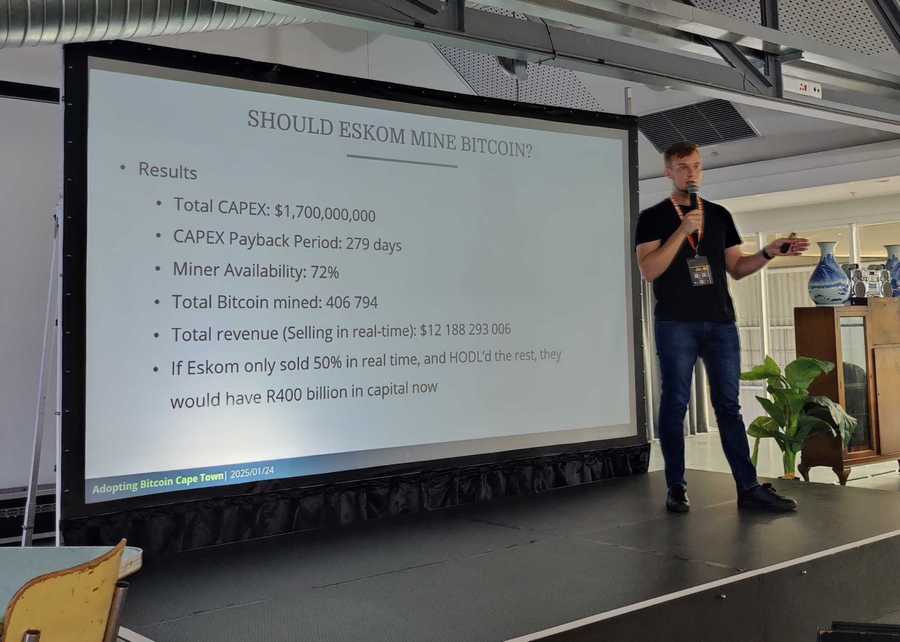

- Convince South Africa’s monopoly energy provider Eskom to embrace Bitcoin mining to facilitate grid management and expansion. Carel showed some calculations that if Eskom did CapEx of R1.7 Billion in 2021, and kept 50% of the mining proceeds, they would have made a surplus of 400 Billion Rand, which is equal to their total current debt (which is backstopped by the tax payer). They hoped to announce a mining agreement at the conf, but the talks are still in progress. Apparently the holdup is on the government’s side, which is the shareholder.

- Convince the Reserve Bank and Intergovernmental Fintech Working Group (IFWG) to change legislation which currently blocks the creation of a Bitcoin holding company modeled on Microstrategy.

Circular Bitcoin economies and microgrids

Other smaller talks were about establishing circular Bitcoin economies in South Africa and other African countries (Kenya, Malawi, Burundi) of which there are a bunch by now. One South African township shopkeeper mentioned that since he accepts and saves in Bitcoin, he has stopped drinking alcohol and instead of partying at the tavern over the weekend, he spends time with his wife and child. Saving in Bitcoin changes people for the better.

There was a talk about BTrust, which is a non-profit which received 500 Bitcoin from Jack Dorsey and Jay-Z, and about Gridless, which has built 5000 micro-grids in rural Africa to provide electricity to rural communities, subsidised by Bitcoin mining and which would otherwise not have been economically feasible.

Politicians

Helen Zille

Political Bigwig Helen Zille held a talk about her son who orange-pilled her some years ago and how she’s now saving in Bitcoin. Somewhat cynically I think she came mostly because her party didn’t want to be upstaged by another politician, Mzwanele Manyi, who came to announce his party’s proposal for a strategic Bitcoin reserve for South Africa.

Mzwanele Manyi

One very strange thing is that Manyi’s party, MK, is not just calling for a strategic Bitcoin reserve, but also the nationalization of the central bank, the private banks, mines, factories and forced land expropriation without compensation, all to be owned by the state for the purposes of redistribution. Doesn’t sound like the kind of party that would propose a strategic Bitcoin reserve, does it?

In Many’s talk, he highlighted illegal exchange rate manipulation from the private banks in 2023 to enrich themselves (they were fined for this).

He mentioned key advantages of Bitcoin that are well known to Bitcoiners.

- The removal of unnecessary financial intermediaries, which according to him is where a lot of corruption happens.

- Fixed supply

- Operates on principles of transparency and fairness.

- Would reduce South Africa’s dependency on international institutions like the IMF.

Some other things he mentioned:

- El Salvador. They’ve demonstrated the benefits. They successfully repaid an $800M bond, helped by Bitcoin.

- Single biggest line item in SA’s budget is debt servicing. Higher than anything else.

- Wants to use Bitcoin to reduce SA’s debt burden. (Zille’s position was that this would cause a currency crisis and is not a good idea).

- Proposal: that SA must allocate between 4-5% of reserves into Bitcoin, R50 billion. Expects it to grow to R380 billion in 5 years.

- He is explicit that he wants SA to front-run the USA.

- They are soon going to table a discussion on this in Parliament.

The game theory that Bitcoiners have mentioned since years is starting to play out.

A question was asked about how to reconcile MK’s non-free market interventionist policies with Bitcoin’s libertarian ethos. Manyi’s response is that he doesn’t want to be boxed in ideologically and that he is interested in pragmatism and not ideology. Says libertarians want the same as everyone, but the starting position is not the same. He says “let’s level the playing field so that we can then have a free market.” Says affirmative action must not be perpetual, must eventually stop, but first needed to level the playing field.

Beverley Schafer

Up next, was Beverley Schafer, who was a politician for 15 years.

35 million people in SA earning less than R1000 per month. Complains that she can’t open accounts at exchanges because she’s been an active politician in SA and is now a “politically exposed person”.

Says she was forced to find non-KYC alternatives to stack sats. Says existing fiat systems don’t prioritise freedom, they prioritise control. In South Africa, the central bank ties us to a depreciating currency which between 2010 and 2023 lost 60% against the US dollar.

She’s quite clued in. Quotes Jeff Booth. Encourages self custody and taking a long-term approach. Says she made mistakes on her Bitcoin journey, but has learned how to save and to commit to the long game.

Cross-border payments via Lightning

There was an announcement by Orange, which is using the Lightning network to facilitate cross-border remittances across Africa. By using Lightning, you need zero float, i.e. you don’t need to keep large pools of rapidly depreciating African fiat currencies, because sats are so fungible. They partner with OTC desks on both sides. In doing so, they drastically reduce fees for customers.

They did two live demos.

R104 worth of Nigerian Naira was sent from a Nigerian bank account to a South African one, with the cross border payment made over Lightning. It took about 2 minutes for the money to show up in the South African bank account.

Another where Kenyan Pesa worth R111 was made from a Kenyan mobile account (via MPesa, which is big in Kenya) to a South African bank account.

Chatting with the organizers

I had some conversations with the organizers and heard a few interesting tidbits. Not everything appropriate for sharing publicly here.

They ran their own BTCPay server and everyone who attended paid in Bitcoin, with most paying via Lightning.

People already started paying for tickets in the middle of 2024, so they made a nice profit. They also saved around R40.000 in credit card processing fees.

The attendees

The attendees were an eclectic mix. There was a well known Billionaire, the politicians, a think tank CEO, some civil society leaders, VCs, local entrepreneurs and plebs.

One guy raises chickens and sells the eggs for Bitcoin. I saw a lady I know from outside of Bitcoin, who started an off-grid hippie community in a nearby forest.

The conference was small. Compared to the large overseas ones, it’s more like a large meetup. The nice thing however was that this made everyone accessible, and I had lots of interesting conversations.

Hello, I'm JC Brand, software developer and consultant.

I have decades of experience working with open source software, for governments, small startups and large corporates.

I created and maintain Converse, a popular XMPP chat client.

I can help you integrate chat and instant messaging features into your website or intranet.

Don't hesitate to contact me if you'd like to connect.